Giovanni Ugut and Aktsa Efendy are both fellow Indonesian Cornellians. Giovanni is currently part of the energy coverage group of a leading Canadian investment bank, and Aktsa is a serial tech operator and venture capitalist focused on Southeast Asia.

ASEAN, home to over 660 million people and the world’s fourth-largest energy consumer, is alarmingly reliant on fossil fuels, contributing to 6.5% of global energy-related carbon dioxide emissions in 2020.

As international pressure mounts on ASEAN nations to expedite their decarbonisation goals, the region’s collective shift towards clean energy remains slow. In contrast to the decarbonisation policies of China and the United States, ASEAN has only recently drummed up initial plans in its foray into the realm of sustainable energy policies, with the likes of Indonesia making early strides first with multiple fiscal and non-fiscal regulatory incentives to ramp up EV adoption and the recent launch of the IDX-operated carbon credits exchange

We posit that it is imperative for private capital to back builders that are actively proliferating the renewable energy supply base to drive clean energy’s cost competitiveness already achieved by more developed markets and ultimately allow ASEAN to inch closer towards net zero.

US’ success provides inspiration but challenges persist

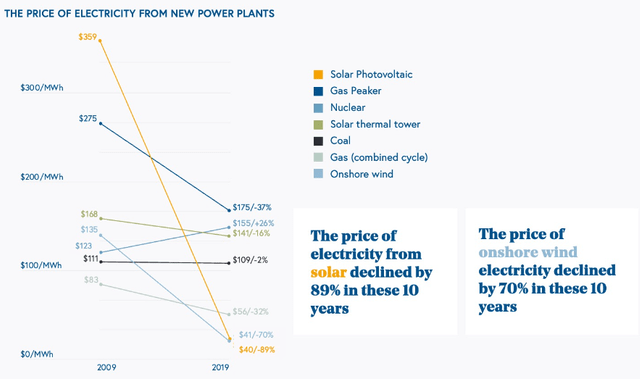

In just a decade between 2009 and 2019, on a per MWh basis, the US has seen the price of electricity generated from solar and onshore wind drop by 89% and 70% respectively, ultimately becoming more than 62% cheaper than energy from coal.

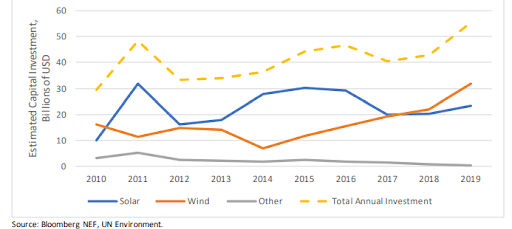

To achieve this, there was a triad of favourable policies such as the 26% Federal Solar Tax Credit for installed solar PV systems. The US also witnessed a massive capital outlay by both the public and private sector with over $50 billion in total annual investments in renewable energy in 2019 alone (see chart below). Moreover, there was enough innovation as well as venture capital—over 2,700 unique existing tech ventures in the renewable energy tech space, and an over 6x growth in total VC funding in circa 2019-2022, clocking over $12.3 billion in total investments last year alone.

Annual investment in the US Renewable Energy market

In the ASEAN region, meanwhile, there are a few challenges that have impeded the ability to transition as swiftly as desired towards renewables:

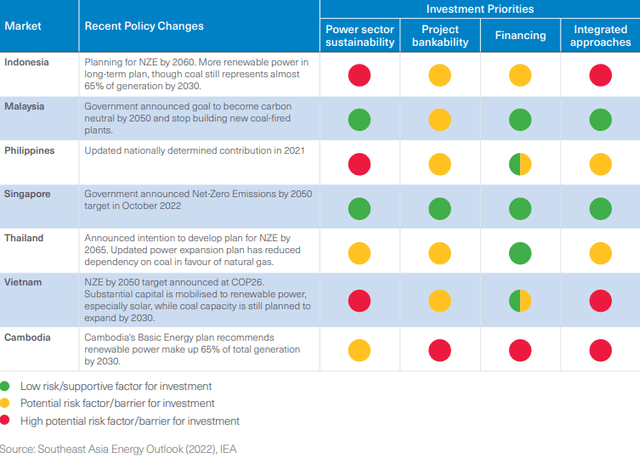

- Policy fragmentation: ASEAN comprises diverse nations, each with its own energy policies. This lack of harmony impedes cross-border energy initiatives and stymies region-wide adoption of renewables. For example, there are six out of 10 countries in ASEAN that do not have a Long-term Emissions Development Strategy (LT-LEDS) which outlines detailed policy plans and specific sectoral road maps. This lack of alignment is a significant challenge for the region, as it makes it difficult to coordinate efforts and achieve the renewable energy targets set by ASEAN countries.

- Inadequate investment frameworks: The ASEAN region’s regulatory framework for renewables lags global standards, creating investment hurdles. As the International Energy Agency notes, ASEAN’s less transparent regulations dissuade potential investors, with Indonesia’s slowed renewable approvals being a case in point. This is concerning given that ASEAN requires a substantial $1.5 trillion in capital injection by 2030 to modernise its energy infrastructure and meet climate targets. Reforming these frameworks could catalyse investments, fostering both economic growth and reduced fossil fuel reliance.

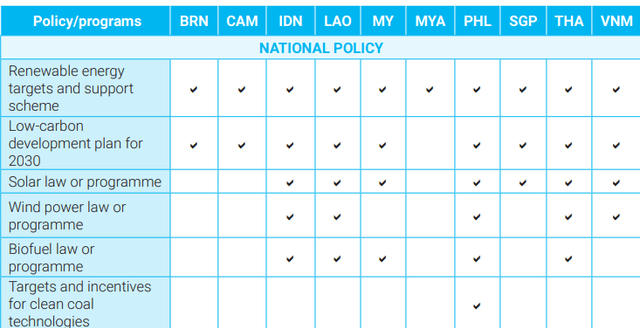

Climate policy ambitions and risks in SE Asia

3. Trade Barriers: Trade barriers and inconsistent policies hinder ASEAN’s shift to renewable energy. While all ASEAN countries offer tax incentives for renewables, only Indonesia and the Philippines provide VAT exemptions. Local content rules in nations like Indonesia prioritise domestic over foreign suppliers, affecting trade. Policy misalignment, especially in Indonesia, and underutilised free-trade agreements further restrict the sector’s growth. Simplified policies and better regulations are crucial for a smoother transition.

Policies and incentives for renewable energy in ASEAN

4. Outdated Grid Integration: ASEAN’s renewable energy shift is hampered by outdated grid standards, with only 30% ready for such integration, as per the International Renewable Energy Agency (IRENA). While Malaysia and the Philippines have made strides in grid improvements and management, Indonesia has a congested grid and insufficient inter-island connectivity to create a reliable power supply. As the region moves away from fossil fuels, modernising these grid standards becomes imperative for a seamless renewable transition.

5. Higher Offtake Risk: ASEAN’s renewable energy investments face heightened offtake challenges because state-owned utilities (SOUs) regulate electricity generation and are the sole buyers of power, such as Indonesia’s PLN, Malaysia’s TNB, and the Philippines’ Meralco.

Playbook for clean energy startups and investors

Private capital can look to back tech ventures spurring the growth of renewable energy supply while removing the need for massive upfront costs, by providing more accessible purchasing schemes.

Examples of solar that demand zero upfront investments include East Ventures- and New Energy Nexus-backed Xurya, and Indonesia-based startup that services Commercial & Industrial (C&I) clients with multi-decade contracts; and Solar AI Technologies, a Undivided-, Earth VC- and Investible-backed startup that provides rooftop solar-as-a-service products for Singaporean homeowners that can reach payback in less than a decade.

The caveat here is that while such ventures have made massive strides in making their models as asset-light as possible, patient, heavy capital is expected when backing these types of models, especially given that projects can cost up to more than half a billion dollars in capex per MW of energy.

The long-term market opportunity in ASEAN for renewable energy is substantial, with electricity consumption growing at a rate exceeding the global average of 4% per year.

Based on internal estimates, the market ceiling for renewable energy in Indonesia alone exceeds $5 billion, assuming a conservative 10% market capture (similar to the current US renewable energy supply at 13%).

Additionally, there is a growing interest from investors in the clean energy lending market. This opportunity is particularly significant given that major renewable energy players like Sinarmas-affiliate SUN Energy, Ayala-affiliate ACEN, and Total Energy’s Southeast Asian practice primarily focus on large-scale solar projects in the region.

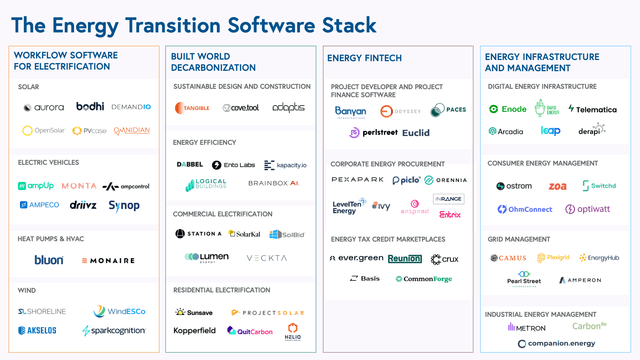

In the future, we are equally as excited at the prospect of private equity flowing into entrepreneurs looking to hyper-localise asset-light energy transition software models for the ASEAN market. In general, three key things remain relevant when building and investment-assessing these plays.

Firstly, it is critical to understand how end customers perceive the operational efficiency upside and thus return on Investments (RoI) in adopting and embedding software into the energy transition workflow, which can ultimately help circumvent the initial challenge of selling to industry laggards without having to rely solely on regulatory tailwinds. For example, Pear VC-backed Aurora Solar has enabled solar PV installers to reduce the need for physical visits to homes and streamlined the process of evaluating homes for solar panel installations, resulting in the swift creation of customer-ready designs and proposals to expedite sales and thus drive toplines.

Secondly, while software models typically aim to solve a very specific problem within any energy transition value chains as do any vertical software plays, it is necessary to develop an expansionary blueprint aimed at creating business models that benefit as a function of customers’ growth, thus shifting from merely being a product-centric entity to becoming a business with a substantial Total Addressable Market (TAM). For example, Ulu Ventures backed Banyan Infrastructure, which offers origination and portfolio management solutions to banks and investors who fund sustainable infrastructure development, eventually managed to not only charge SaaS fees but also charge annual fees per processed loans that thus command substantial recurring revenue that expand as their customers’ business augment as well.

Lastly, in devising go-to-market strategies, it might be worthwhile to explore joint partnerships to streamline adoption, especially as we foresee emerging energy transition software startups facing difficulties in acquiring customers initially through direct sales because they must first secure support from various stakeholders, integrate their software with existing solutions, and build trust in their offerings. For example, Indonesia-based, ex-Tesla-Hyperloop-engineer-founded Blitz Mobility pairs itself with existing 3PL players such as the likes of JNE and Paxel in order to not only now provide two-wheeler EV delivery options to their existing customer base such as e-commerce platforms like Lazada, but support said 3PL businesses with the ability to route-optimize their fleets, allowing them to unlock growth in delivery volumes, optimise delivery costs and time; and ultimately enhance profitability margins.

Ultimately, our advocacy for private capital to flow into energy transition tech models is rooted in the optimisation of returns in an environment where the costs of capital is as high as it is right now. Investors can be adequately rewarded given the opportunity to back technology that materially pushes ASEAN closer to its clean energy agenda.